Things have been a bit quiet on the “gun front” lately (good news because it means fewer people than normal are dying as a result – hopefully it will stay that way), though this item recently appeared, including the following…

Beretta U.S.A. announced Tuesday that company concerns over a strict gun-control law enacted in Maryland last year have made it necessary to move its weapons making out of the state to Tennessee.

The well-known gun maker said it will move to a new production facility it is building in the Nashville suburb of Gallatin that is set to open in mid-2015.

Beretta general manager Jeff Cooper said that a sweeping gun-control measure that was passed last year initially contained provisions that would have prohibited the Italian gun maker from being able to produce, store or even import into Maryland the products that the company sells around the world. While the legislation was changed to remove some of those provisions, Cooper said the possibility that such restrictions could be reinstated left the company worried about maintaining a firearm-making factory in Maryland.

So Beretta decided to move their operations from Maryland to Tennessee supposedly because of those gol-darned liberals and their danged gun laws, even though the Maryland legislation was changed to try and mollify Beretta.

However, I think we need to note something else (from a related story here)…

Beretta said they will not begin the transition process of moving production to Gallatin until sometime in 2015. The company added it had no plans to relocate its office, administrative or executive support functions from the Maryland facility.

Really? I wonder why not? I mean, if you’re gonna “talk the talk” about moving all the jobs, then why not actually, y’know, move all of the jobs.

Could it possibly be because, as noted here, the state minimum wage for Maryland is $7.25 an hour, but for Tennessee…well, there is no state minimum wage?

Maybe Tennessee deserves Beretta, and I don’t mean that as a compliment; here, the reviewer of Beretta’s Cx4 Storm, which apparently can substitute as a semiautomatic pistol, concluded that “it is basically a weapon designed to kill and maim people in a quick, efficient manner…In the hands of even an unskilled shooter, it can still accomplish that purpose quite effectively.”

Terrific.

Johnson, who left the Planned Parenthood clinic in Bryan, Texas in 2010, released a budget statement for the 2010 fiscal year she said shows that the clinic was expected to perform at least 1,135 abortions that year.

Johnson’s group, And Then There Were None, released a photograph a few weeks ago of a Colorado clinic receiving an award for having performed more abortions in the first half of the 2013 fiscal year than they had in the second half of the 2012 fiscal year.

Even though, as noted here according to the law, no federal funds are allowed to be used for abortions (so basically, if there had been an audit, that Planned Parenthood office would have lost its federal funding).

I find Johnson’s claims hard to believe, particularly when you consider the following (here)…

(Johnson), a former Planned Parenthood employee turned antiabortion activist, gave a workshop at Heartbeat International’s 2012 conference titled “Competing With the Abortion Industry.” According to audio of the event, Johnson told participants, ”We want to look professional. We want to look businesslike. And yeah, we do kind of want to look medical.” She discouraged them from foregrounding their religious affiliation, so as to better trick women: “We want to appear neutral on the outside. The best call, the best client you ever get is one that thinks they’re walking into an abortion clinic. Those are the best clients that could ever walk in your door or call your center, the ones that think you provide abortions.”

Before she engages in any more deception on matters related to women’s health care, I honestly think Johnson ought to get straight on the whole “not bearing false witness” thing in accordance with the faith she claims she’s trying to practice. Particularly since, despite her best efforts and those of her fellow wingnuts, Roe v. Wade still happens to be the law of the land.

According to the Los Angeles Times, the number of immigrants younger than 18 who were deported or turned away from ports of entry declined from 8,143 in 2008 to 1,669 last year. There were 95 minors deported from the entire interior of the country last year.

Of course, far be it for Lowry to note the effects of the William Wilberforce Trafficking Victims Protection Reauthorization Act of 2008 which, as noted below, was passed and signed into law by Former President Highest Disapproval Rating In Gallup Poll History (here).

In 2008, in the lame-duck session of a presidential year when the party’s president and nominee were both immigration reformers, Congress easily passed the (Act – Wilberforce was a British parliamentarian who led the slavery abolition movement). No one in the House or Senate opposed a law intended to rescue children from exploitative pimps—legislation that allowed young people to attain “special immigrant juvenile status.” The Obama administration is citing this as the reason why deportations have plunged, and asked Congress to fix it.

Oh yeah, like that will happen with Boehner and company, who never imagined a “scandal” they didn’t like concerning this president.

Oh, and I know I’m going out of order a bit, but Lowry inflicts the following also…

The first rule in a crisis for any executive is put on his windbreaker and boots and get out on the ground. President George W. Bush didn’t do it soon enough after Hurricane Katrina and, politically, could never make up for it, no matter how many times he visited New Orleans subsequently. Obama’s bizarre resistance to visiting the border on his fundraising swing out West fueled talk of the influx as Obama’s “Katrina moment.”

HAHAHAHAHAHAHAHA!!!!!!!!!

To begin, I don’t know if it matters one bit whether or not President Obama goes to the border; as noted here, he described such a move as “cheap theater,” which I think is absolutely correct. Besides, as noted here, many of Obama’s most vocal critics on this haven’t been to the border either, including “Man Tan” Boehner, Rep. Cathy McMorris Rodgers (R-Wash.), and Sens. John Barrasso (R-Wy) and the thoroughly odious Ron Johnson (R-WI). You can also lump “Calgary” Cruz into the mix, along with Reps “Smokey Joe” Barton and Jeb Hensarling, all of Texas, which is particularly ridiculous (more on Hensarling shortly).

Also, I really think the wingnuts should give the “Obama/Katrina” thing a rest, particularly when you consider the following from here; I believe the only tragedies and/or foibles that our corporate media haven’t declared to be an “Obama/Katrina” moment would be the Chicago Fire, the Kennedy assassination (either one), the Challenger shuttle disaster, and the wreck of the Edmund Fitzgerald (you can Google it, the event and/or the song – apparently, everything else is fair game).

Thanks to the Consumer Financial Protection Bureau’s Qualified Mortgage rule, Dodd-Frank makes it harder for low and moderate-income Americans to buy a home. According to a Federal Reserve study, roughly one third of African-American and Hispanic borrowers would not be able to obtain a mortgage based solely on the CFPB’s debt-to-income requirements.

In response, I give you the following (here)…

Dodd-Frank tried to (put in place) new consumer protection rules requiring banks to verify a borrower’s ability to repay a loan before extending it. At Wednesday’s hearing, much of the GOP criticism focused on false allegations about the Consumer Financial Protection Bureau’s Qualified Mortgage regulation, or QM.

“You don’t protect consumers by taking away or limiting products, like the CFPB does through the Qualified Mortgage rule,” Rep. Sean Duffy (R-Wis.) said.

The QM rule doesn’t ban anything. It’s a basic test of whether a loan is designed to line a lender’s pockets by ripping off a borrower. And it gives banks special perks for meeting the CFPB’s high-quality loan standards, protecting them from predatory lending lawsuits. In practice, that means limiting the amount lenders charge in points and fees to 3 percent of the loan value, banning balloon loans with a big lump sum due at the end of the mortgage…

…

Hensarling was particularly vocal about the Dodd-Frank law’s effect on minority borrowers, claiming a Federal Reserve study shows that “about one-third of blacks and Hispanics would not be able to obtain a mortgage,” based on the rule’s requirement that monthly borrower debts not exceed 43 percent of monthly income.

That’s true, according to the Fed’s 2010 data. It’s also generally considered bad personal finance to have that much of your income tied up with debt payments.

Also, this tells us more about the CFPB’s mortgage rules modifications. And as far as debt-to-income requirements, I give you the following from here…

Lenders will have to verify borrowers’ income, assets and debt before signing them up for home loans. Such common-sense practices anchored the mortgage market for decades but were cast aside in the lead-up to the meltdown as banks relaxed standards to churn out more lucrative loans. The result was millions of homeowners who were unable to manage their mortgages once the market tanked.

And…

In response, the CFPB has created a category of home loans that offer lenders broad legal protections against borrower lawsuits, provided they adhere to certain criteria. These “qualified mortgages” limit upfront fees and bar risky features such as no-interest periods that can leave homeowners stuck with unsustainable loans.

Hensarling also propagandizes as follows…

Dodd-Frank’s Volcker rule makes U.S. capital markets less competitive against other international financial centers. It’s more expensive for U.S. companies to raise working capital and harder for Americans saving for retirement or their children’s college educations.

In response, this tells us more about the supposedly dreaded “Volcker rule”…

A federal regulation that prohibits banks from conducting certain investment activities with their own accounts, and limits their ownership of and relationship with hedge funds and private equity funds, also called covered funds. The Volcker Rule’s purpose is to prevent banks from making certain types of speculative investments that contributed to the 2008 financial crisis.

Here is more from Hensarling…

Dodd-Frank created the Financial Stability Oversight Council and gave it the power to designate certain large businesses as “Systemically Important Financial Institutions” (SIFIs). Now insurance companies that pose no discernible systemic risk to the economy are being subjected to unnecessary regulation that dries up capital for infrastructure projects, and harms investors and policy-holders.

In response (here)…

AIG and GE Capital chose not to fight the (Financial Stability Oversight Council’s) efforts to bring them under tougher regulatory scrutiny (by declaring them SIFIs).

“AIG did not contest this designation and welcomes it,” the company said in a statement on Tuesday.

Russell Wilkerson, a spokesman for GE Capital, which is the financial services arm of General Electric, said the company had been prepared for the council’s decision.

“We have strong capital and liquidity positions, and we are already supervised by the Fed,” he said.

The oversight group does not name companies under consideration for this designation until it makes a final decision, but AIG and GE Capital had previously disclosed that the council had proposed declaring them systemically risky.

Prudential Financial had also disclosed that the council had proposed designating it as systemically risky, but the company last week said it would contest the proposal by asking for a hearing before the regulatory group.

I think we’ve figured out at this point that Hensarling and his pals are doing everything they can to try and scuttle financial reform, which is perfectly in lack of character for a guy who believes in fairy tales about how those alleged deadbeats with credit card balances are hurting the “bottom line” of the lending institutions – actually, as the poster notes here, the opposite is true.

Hensarling, by the way, is chairman of the U.S. House Financial Services Committee. And do you know who else serves on that committee?

Why, our own Mikey the Beloved, of course – with that in mind, I give you this from the Kevin Strouse campaign (running to unseat Mikey in PA-08)…

Four Years After Authorization of Consumer Financial Protection Bureau, Congressman Fitzpatrick Continues to Advocate for Banks, the Ultra-Wealthy and Special Interests Instead of People

Kevin Strouse exposes Congressman Fitzpatrick’s self-interested votes to protect the big banks and special interests that support his campaign, putting 8th district consumers at risk.

Bristol, PA – Yesterday (7/21) marked the fourth anniversary of the Wall Street Reform and Consumer Protection Act becoming law. The act, which was passed in response to the financial crisis caused by irresponsible banks and self-interested politicians, created the Consumer Financial Protection Bureau (CFPB) to enforce laws and ensure that the financial industry works for all Americans – not just big banks. Democratic Congressional candidate Kevin Strouse called out Congressman Fitzpatrick for his relentless attempts to weaken this law which was designed to regulate many of the big banks and payday lenders who donate large sums to Fitzpatrick’s re-election campaigns.

In 2011 Congressman Fitzpatrick voted to eliminate the director of the Consumer Financial Protection Bureau. On yet another occasion, he voted in 2012 to expand loopholes and exemptions covering derivatives.

Strouse commented, “It’s disappointing that my opponent has taken every opportunity he could to vote to weaken an agency whose sole mission is to protect consumers. Unfortunately, Congressman Fitzpatrick has proven himself to be another self-interested Washington insider who will tirelessly defend the big banks and special interests that he’s supposed to regulate as a member of the House Financial Services Committee, and then willingly turn his back on his middle class constituents.”

Despite Representative Fitzpatrick’s self-interested votes, the Consumer Financial Protection Bureau has made a real difference in peoples’ lives. To date, more than 15 million consumers have received $4.6 Billion in relief and refunds due to actions taken by the CFPB.

Strouse continued, “The people of Bucks and Montgomery counties are simply asking for a fair shot to experience economic opportunity that works for everyone in this country, and voters this fall will have a choice between electing a representative who will work to support middle-class families in the 8th District, or remaining left behind by Congressman Fitzpatrick and the dysfunctional Republican Congress.”

BACKGROUND:

Fitzpatrick voted to limit the effectiveness of the Consumer Financial Protection Bureau (CFPB). [2011, HR 1315, Vote #261]

• The legislation would limit the effectiveness of the CFPB, a bureau created by the Dodd-Frank financial regulatory bill, which “has the authority to regulate financial markets in ways meant to improve consumer protection”. The CFPB, which had a single director, would instead have a five-member board. This legislation would also change the two-thirds majority vote by the Financial Stability Oversight Council to override a CFPB decision to just a simple majority. [The Hill, 7/21/11; Washington Post, 7/22/11]

• Philadelphia Inquirer: Fitzpatrick voted to “Muzzle” the CFPB… [Philadelphia Inquirer, 7/27/11].Fitzpatrick Voted to Expand Loopholes, Exemptions in Dodd-Frank Wall Street Reform Bill [HR 3336, Vote #180, 4/25/12]

• In 2012, Fitzpatrick voted to expand loopholes and exemptions covering derivatives in the Dodd-Frank Wall Street reform law. According to CQ, the bill “would exempt certain financial institutions regulated by the Commodity Futures Trading Commission (CFTC) from classification as swap dealers under Dodd-Frank. The law included a similar exemption for depository institutions and supporters say the change would allow farm credit institutions that are not designated as depository institutions to offer swaps to protect customer loans from sudden interest rate fluctuations.” [CQ, 4/25/12]

15 million consumers will receive $4.6 billion in relief due to actions taken by the CFPB. Source here.

###

Kevin Strouse is a former Army Ranger, CIA counterterrorism analyst, and veteran of Iraq and Afghanistan who lives in Middletown, Pa., with his wife, Amy, and two young children, Walter and Charlotte. He is currently Program Director of Teach2Serve, a non-profit that teaches social entrepreneurship to local high school students. He earned his BA from Columbia University and a Masters in Security Studies from Georgetown University, graduating with honors.

To support Kevin, click here.

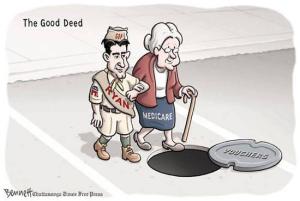

Also related to financial stuff, it looks like none other than Mr.-Puppy-Dog-Eyes-With-The-Shiv is back with some supposedly glorious plan to lift everyone out of poverty with not one dime of new spending or (Heaven forbid!) a revenue increase of any type whatsoever, as his mouthpiece Reihan Salam tells us here…

…Loved by the right and loathed by the left, Ryan has been the architect of the most consequential Republican domestic policy initiatives of the Obama era. In spirit if not in name, Ryan spent much of President Obama’s first term as the leader of the opposition, rallying Republicans against Obamacare and in favor of long-term spending reductions. His controversial calls for entitlement and tax reform as chairman of the House Budget Committee were singled out by the president for over-the-top denunciation. In the spring of 2012, well before Ryan was named the Republican vice-presidential nominee, the president went so far as to characterize the Wisconsin congressman’s budget proposal as “thinly-veiled Social Darwinism.”

Yeah, well, that’s probably because it is “thinly veiled social Darwinism” (here).

So what exactly is Ryan’s supposedly wonderful new plan? Why, to consolidate stuff like SNAP and Section 8 housing funds into a block grant for states, where there is NO POSSIBLE WAY that the funds will EVER be used inappropriately once federal oversight is removed. And of course, there will be NO PROBLEM with people who need housing funds but not food assistance losing out because the latter need will be over allocated by a state instead of the former one. Am I right (more here)?

Somehow I have a feeling that, if Hensarling, Mikey and their buddies were serious about balancing the books, they would not have cut the IRS enforcement budget by 25 percent (here). They also would not have recently passed “a whopping $287 billion business tax cut measure with no effort to pay for or offset that amount” (here).

And as former Reaganite Bruce Bartlett points out here…

As far as tax reform is concerned, the problem for Republicans is they don’t actually believe in the “reform” part of tax reform. That would be the part that eliminates unjustified tax cuts and loopholes to pay for statutory rate reductions. In their heart of hearts, Republicans only believe in tax cuts, especially for big corporations and the ultra-wealthy. They, like the right wing novelist Ayn Rand, believe that only the wealthy create wealth. Average workers are greedy parasites, especially when they have the temerity to join a union and, like Oliver Twist, ask for “more.” The Republican establishment pulled out all the stops recently to kill the unionization of an auto plant in Tennessee lest workers get too uppity.

Hmm, Tennessee huh? The same state where Beretta decided to move the majority of its workforce, as noted earlier. I guess it’s just a coincidence that Tennessee is also, apparently, virulently anti-union, huh?

I know better minds than mine have said this before, as I have also, but it needs to be repeated again. The Party of Reagan wants to take from the “have less” crowd and give to the “have more” crowd any way possible, and they don’t give a damn about balancing the budget or growing the economy. When it comes to their supposed fiscal stewardship, here endeth the lesson.

Many Pennsylvania drivers have long-awaited the increasing of the maximum speed limit. That day is coming next week.

The speed limit will be raised to 70 mph on a 100-mile stretch of toll road in the south-central part of Pennsylvania, the Pennsylvania Turnpike Commission announced Friday.

The 70 mph zone will be on the Turnpike mainline (Interstate 76) between the Blue Mountain Interchange (Exit 201) and the Morgantown Interchange (Exit 298) starting Wednesday.

Turnpike officials are planning a news conference for next week to detail future speed-limit changes across the Turnpike’s 550-mile system.

“Our studies have shown that the design of our system in this area can safely accommodate the higher speed limit,” Pa. Turnpike CEO Mark Compton said in a news release.

“But motorists must remember that it is their responsibly to drive safely and sensibly according to the traffic and weather conditions — especially when the pavement is slick from precipitation or when visibility is limited.”

State police say they’re planning strict enforcement of the 70 mph limit.

I drive the PA Turnpike a lot, but I must confess that this isn’t really the best news as far as I’m concerned. Unless this is the proverbial Trojan Horse in the sense that the state police are dressing this up as a very attractive carrot, when in reality they plan to turn it into a cash-raising stick via higher fines for speeding offenses, which is another story.

I drive the stretch from Downingtown to Trevose/Bensalem, Pa. a lot (don’t ask me the exit numbers; I committed the old ones to memory and can’t remember the news ones), and though there has been a bit of a break with traffic volume for the summer vacations, I envision this stretch of road turning into even more of a demolition derby when most of the drivers come back if a speed limit of 70 is ever put into place.

Yes, I’m frequently around 70 myself, and mainly I’m just keeping up with traffic flow. But in time, the “unofficial” speed will tick upward, probably closer to 80. And again, on that stretch of the turnpike, that is too damn fast of a speed to maintain, particularly when you consider this (first bullet). I am also old enough to recall when discussions about raising the speed limit also discussed whether or not that led to energy savings; no sign of that here that I can tell.

My motivation behind saying this is simple; I’m trying to keep people alive, including myself. And if that means I’m forced to drive, say, 5 to 10 miles slower on my route than I would if I were approaching, say, Harrisburg, then that’s a small price to pay as far as I’m concerned.

Oh, and something else – as long as I’m discussing the PA Turnpike, can we please speed it up a bit with building the I-95 connector near Bristol? Also, replacing the rest stop where the Street Road EZ Pass ramp is now located would be a good idea too. Can you please make it so?

Hugs…

Posted by doomsy

Posted by doomsy